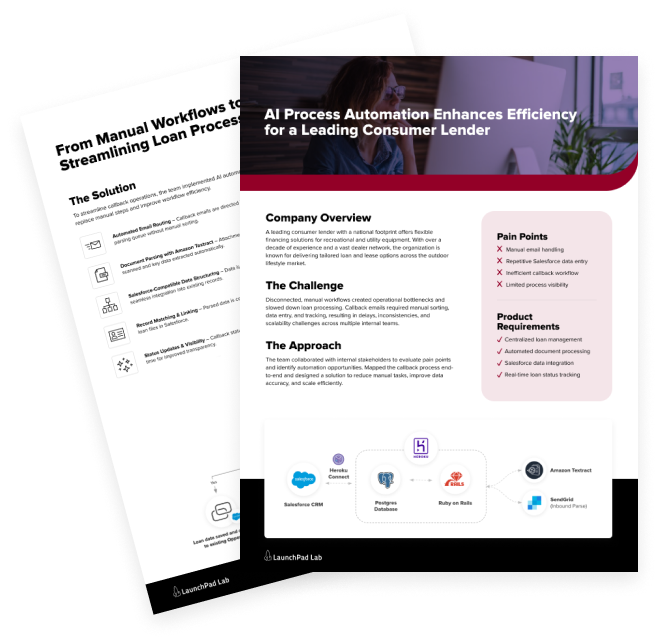

Discover how a leading lender used AI process automation to streamline callback handling, eliminate manual workflows, and improve operational efficiency.

Company Overview

A leading financial services provider, with a nationwide footprint, specializes in offering flexible consumer financing solutions for recreational and utility equipment. For over a decade, the organization has supported dealerships and end customers by delivering tailored loan and lease funding options. Their established network and deep industry expertise have made them a go-to partner for financing needs across the outdoor lifestyle and equipment market.

The Challenge

The loan approval process was resource-intensive and involved a series of disconnected manual steps. Internal teams managed email submissions, manually entered data into Salesforce, and processed callbacks without standardized workflows. This slowed down response times, introduced risks for human error, and limited the team’s ability to scale operations efficiently.

The lender partnered with LaunchPad Lab to bring a technology-first solution to market with AI process automation.

The Approach

The team worked closely with stakeholders to understand business goals, assess existing workflows, and uncover where technology could drive the greatest impact. By mapping the current process and identifying automation opportunities, the team defined a focused strategy for applying AI automation to callback handling and communication workflows.

To streamline callback operations, the organization deployed an AI-powered solution to eliminate manual data handling and improve responsiveness. The system enhances accuracy, reduces processing time, and supports scalable loan operations by automating a core workflow previously reliant on email and manual entry.

Attached loan documents are automatically scanned and parsed to extract borrower information, decision data, and other key inputs.

Parsed data is formatted and structured to match the Salesforce schema, ensuring consistency and easy integration with loan records.

Relevant data points are matched to existing loan applications in Salesforce, with documents and decision data linked to the appropriate record.

Callback stages and document statuses are automatically updated within Salesforce, improving transparency and team coordination.

The Results

AI process automation of the callback workflow led to substantial improvements in operational efficiency and team performance:

✓ Reduced Administrative Load: By eliminating repetitive tasks like manual data entry and email parsing, the team freed up hours of administrative time each week to focus on higher-value customer work.

✓ Faster Loan Processing: The AI-driven workflow shortened the time from application to lender recommendation, speeding up prequalification and reducing delays in the approval process.

✓ Improved Callback Accuracy: Automatically parsing email attachments and linking them to the correct record in Salesforce reduced human error and improved response consistency.

✓ Scalable Workflows: With AI automation in place, the platform can support a growing volume of loan applications and dealer activity without adding operational headcount.

✓ Enhanced User Experience: The new process delivers real-time updates, transparent status tracking, and quicker turnaround times, improving satisfaction for both borrowers and partners.

Partner with us to develop technology to grow your business.