Discover how Ironhorse Funding built a secure credit application allowing consumers to pre-qualify for financing or refinancing a wide range of vehicles.

Company Overview

Ironhorse Funding is a leading provider of innovative, technology-driven, full-credit spectrum finance solutions to consumers and dealers in the motorcycle, powersports, RV, and marine markets. In contrast to the automobile industry, where specialized lenders are abundant, the motorcycle, RV, power sports, and marine markets have fewer financing options. Although local credit unions are a common choice for consumers seeking financing, Ironhorse Funding stands out among the limited number of national lenders as one of the only ones offering direct-to-consumer financing.

The Challenge

The Ironhorse Funding team processes thousands of monthly applications from consumers applying directly and from its dealer networks. With very few national lenders offering direct-to-consumer (D2C) lending options in this space, there was a growth opportunity to improve the consumer experience, starting with a quick and easy pre-qualification process.

One major blocker for the organization was the inability to run soft credit pulls to pre-qualify applicants. Consumers were required to provide a social security number (SSN), which would immediately result in a hard credit pull. There was no way to capture partial application data, so if an applicant started an application and left, the system didn’t have the information required to follow up on that interaction.

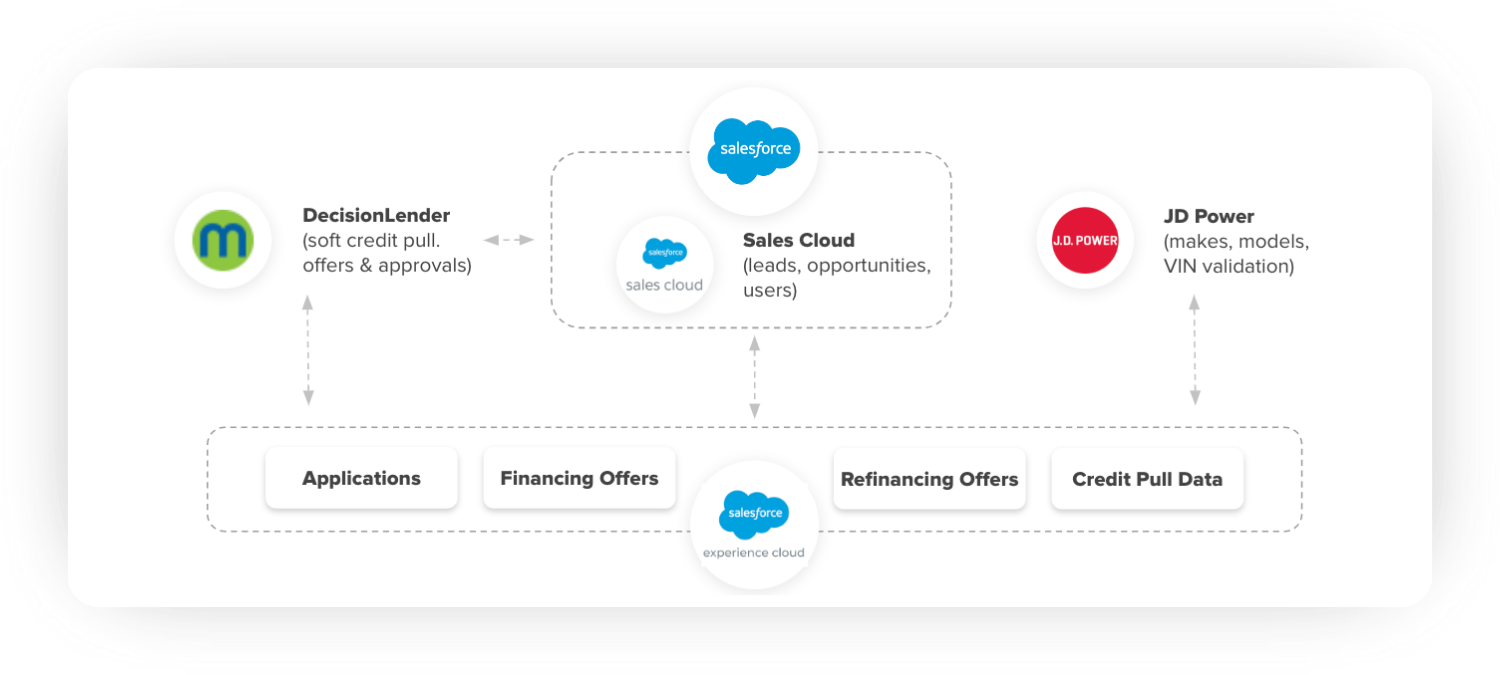

To resolve the cumbersome process and poor data integration, the organization set out to provide a stand-out pre-qualification experience and a streamlined, self-paced online process for consumers that integrated seamlessly within its Salesforce ecosystem. The Ironhorse Funding team turned to LaunchPad Lab as their digital product partner based on the company’s expertise in Salesforce integration.

To kick off the project, LaunchPad Lab facilitated a Blueprint Workshop with the Ironhorse team. With a clear understanding of the organizational challenges and vision for the project, the LaunchPad team mapped out plans for building an application that made it easy to apply for financing a new vehicle or refinance an existing loan.

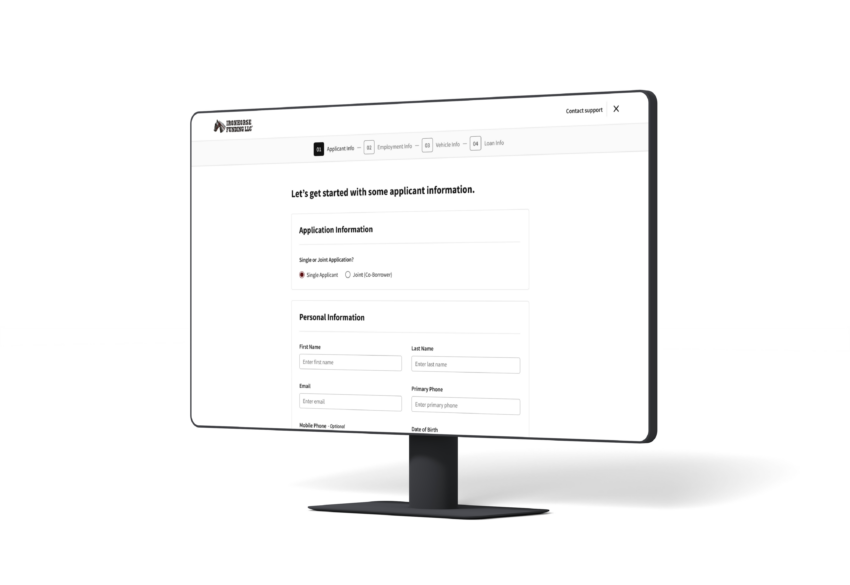

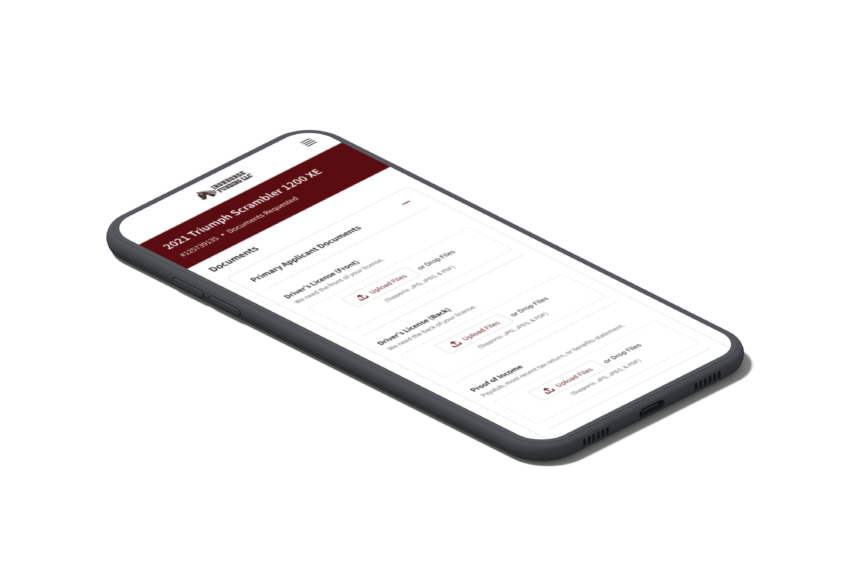

The product would include a landing page with a step-by-step loan application form that makes it easy for consumers to submit their personal information and documentation. The subsequent data captured needed to integrate seamlessly into the Salesforce ecosystem to save time and boost efficiency. Additionally, the portal would offer more self-serve options, enabling consumers to move through the process and finish their loan applications at their own pace — even outside core business hours.

Given the objectives, the tech stack chosen included:

To ensure a successful launch and smooth transition, LaunchPad Lab trained Ironhorse Funding’s Salesforce team to ensure they were confident in managing the platform.

This newly designed application enables consumers to complete applications, upload documents, and review loan options easily and at their own pace.

A new front-end application fully integrated with Salesforce supports the future expansion of the consumer experience.

Behind the Scenes

Fueled by a new secure credit application process and seamless Salesforce integration, the partnership yielded impressive results. The product delivered the anticipated outcome, giving consumers a better lending experience with actionable insights surfaced to the organization.

The pre-qualification process allowed applicants to receive swift responses on their loan eligibility, reducing the waiting period and enhancing customer satisfaction.

By automating various steps in the lending process and providing quick access to multiple loan offers to guide applicants through their options faster and convert leads into customers more effectively.

The self-service options enabled customers to manage their financing process independently, improving the overall experience and driving customer satisfaction.

Automating soft credit pulls, data validation, and lead management reduced manual work for team members, enabling them to allocate their time more strategically.

A clear view of abandoned applications and leads ensures a quicker response from both sales and marketing with focus on higher conversions.

By leveraging advanced technology, streamlined processes, and a user-centric approach, Ironhorse Funding strengthened its position as a leader in direct-to-consumer financing for motorcycles, powersports, watercraft, and RVs.

Partner with us to develop technology to grow your business.